The allure of cobblestone streets, the scent of freshly baked croissants wafting through the air, and the distant hum of a bustling Romanian marketplace. As I, a native of France, stepped onto Romanian soil, the thrill of adventure coursed through my veins.

But amidst the excitement of exploring a new land, there lurked a shadowy adversary that many travelers, including myself, often overlook: the silent drain of paying commissions abroad.

Imagine saving for months, maybe even years, for that dream vacation. You’ve planned every detail, from the quaint cafes you’ll visit to the historical sites that await your discovery. Yet, as you navigate through foreign lands, there’s an invisible hand subtly reaching into your pocket, skimming off your hard-earned money. This isn’t a pickpocket or a scam artist but the often-overlooked cost of exchange commissions. A seemingly innocent transaction can, unbeknownst to you, cost you up to 10% or even a staggering 20% of your travel budget.

I learned this the hard way. Sent from the romantic boulevards of Paris to work amidst the vibrant culture of Romania, I was that unsuspecting traveler. Enthralled by the beauty of Transylvania and the warmth of the Romanian people, I was blindsided by the commissions that slowly chipped away at my finances. Each transaction, each swipe of a card, and each exchange at a local bureau was a lesson in the art of international finance. And trust me, I made every mistake in the book.

But as the saying goes, every cloud has a silver lining. My financial misadventures in Romania became a masterclass in navigating the tricky waters of foreign exchange and avoiding the pitfalls of paying commissions abroad. And now I’m here to share those hard-earned lessons with you. Let’s embark on this journey together, ensuring that your next adventure is filled with memories, not monetary regrets.

Disclosure: Some of the links below are affiliate links. This means that at no extra cost to you, The Travel Bunny will earn a small commission if you click through and make a purchase. Thank you!

Why you should be wary of exchange commissions

Navigating the intricate maze of foreign exchange can feel like a dance. One misstep and you might find yourself tumbling into a pitfall of exorbitant fees and hidden charges. The allure to avoid paying commissions abroad might lead you to believe that exchanging cash is your golden ticket. But, like all that glitters, it’s not always gold.

Picture this: you’ve landed in a new country, the air is thick with anticipation, and the rhythm of a foreign land beckons. With a wallet full of your home currency, you’re eager to dive into the local scene. The vibrant marketplace, the tantalizing aroma of street food, the beckoning of local artisans with their crafts — it’s all waiting. But first, you need the local currency.

It’s tempting, oh so tempting, to rush to the nearest exchange office, especially when they flash signs of “low commissions” or rates that seem too good to be true. And sometimes, in a twist of fate, you might stumble upon a rate that’s genuinely favorable. But herein lies the trap. The bustling airport, with its flurry of travelers and the promise of convenience, might seem like the perfect place to exchange your money. Or perhaps that little kiosk just across the border, promising competitive rates.

But let me share a cautionary tale. My grandfather, a seasoned traveler in his own right, once made the seemingly innocent choice of exchanging money right after crossing into new territory. The result? A staggering commission that ate up nearly 20% of his exchanged amount. A simple online check would’ve shown him the stark difference between the official rate and the one he was offered.

The lesson here is clear: preparation is key. Before you embark on your journey, arm yourself with knowledge. Know the official exchange rate, scout out reputable exchange offices, and plan your currency needs. The last thing you want is to be in a picturesque locale, with the wrong currency burning a hole in your pocket. And if you’re new to this dance of currency exchange, remember, your ID or passport is your dance card. Don’t leave it behind, especially not at your accommodation.

In the world of travel, where every experience is a treasure, don’t let the specter of exchange commissions rob you of your hard-earned money. Be savvy, be prepared, and let your journey be one of discovery, not regret.

Top tips to avoid paying commissions abroad

In the grand tapestry of travel, every thread weaves a tale of adventure, discovery, and memories. Yet, lurking in the shadows of these vibrant stories is the silent predator of paying commissions, ready to snip away at the richness of your experiences. As you stand at the crossroads of foreign lands, ready to immerse in their culture and beauty, arm yourself with the shield of knowledge. Dive into these top tips to dodge the snares of paying commissions abroad, ensuring that every coin you spend adds value to your journey, not detracts from it.

Exchange cash smartly

The rhythmic clinking of coins and the rustle of crisp banknotes have a certain magic to them, especially when they’re from a land far from home. Exchanging cash, for many, is the first tangible step into a new adventure, a tactile introduction to a country’s culture and economy. But, like the siren’s song, the allure of cash exchanges can be both enchanting and treacherous.

Picture yourself in a bustling foreign city, surrounded by the cacophony of unfamiliar languages, the aroma of exotic foods, and the vibrant colors of local markets. The excitement is palpable, and you’re eager to dive in. But first, you need the currency that holds the keys to this kingdom. It’s easy to be drawn to the neon signs of exchange kiosks, especially those conveniently located at airports or border crossings. Their strategic placement, however, often comes with a hidden price tag. These locations, while tempting in their immediacy, are notorious for offering less favorable rates, preying on the urgency and excitement of fresh arrivals.

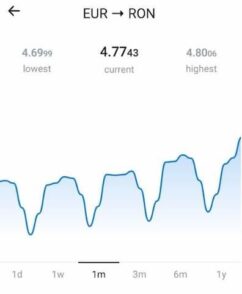

So, how does one navigate this intricate dance of currency exchange? The answer lies in preparation and a dash of tech-savviness. Before setting foot on foreign soil, make it a ritual to check the official exchange rates. Numerous online platforms and apps offer real-time updates, giving you a benchmark against which to measure the rates you’re offered. This simple act can be the difference between a fair exchange and an exorbitant commission.

Furthermore, planning ahead extends beyond just knowing the rates. Familiarize yourself with reputable exchange offices in your destination. Read reviews, ask fellow travelers, and even consider exchanging a small amount in advance. By doing so, you not only secure a safety net for your initial expenses but also buy yourself time to find the best rates once you’re there.

In the grand journey of travel, every decision, no matter how small, shapes the narrative of your experience. By exchanging cash smartly, you ensure that your story is one of exploration and joy, unmarred by the pitfalls of paying commissions abroad.

Maximize your card’s potential

In the tapestry of travel, amidst the vibrant hues of experiences and memories, there’s a subtle thread that often goes unnoticed: the power of your plastic companion, your credit or debit card. This unassuming piece of plastic, tucked away in your wallet, holds secrets and potential that can transform your travel experience.

Imagine the warm golden sands of Morocco, where the desert meets the sky in a dance of colors. As you traverse this land of contrasts, an unexpected twist awaits. A misstep, a sharp pain, and suddenly, the adventure takes a backseat. Here, in this moment of vulnerability, the true potential of your card unveils itself. Not just a tool for transactions, it becomes a beacon of hope, a guardian angel in disguise. From dispatching an ambulance to ensuring a comfortable journey back home, the card’s in-built travel insurance emerges as the unsung hero. No paperwork, no frantic calls, just seamless assistance when you need it the most.

But the card’s magic doesn’t end there. As you journey through quaint European towns or bustling Asian markets, it offers the convenience of cashless transactions. Yet, a word of caution: the world of card payments is layered. Dive deep into understanding your card’s commission structure. While it’s tempting to swipe away, remember that every transaction might come with its own cost. From direct payment commissions that hover around 2 to 2.5% to the nuances of exchange rates, the devil is in the details. And if you’re thinking of withdrawing cash, be wary of the ATMs that lure you with the promise of your home currency. More often than not, it’s a trap that leads to unfavorable exchange rates.

However, it’s not all cautionary tales. With a bit of foresight and planning, you can truly maximize your card’s potential. Before embarking on your journey, have a candid chat with your bank. Understand the fees, the percentages, and the fixed costs. If ATMs charge a fixed fee, strategize your withdrawals. Larger amounts, less frequently, might be the key to dodging those pesky commissions.

In the grand narrative of your travels, let your card be the trusty sidekick, the one that has your back, ensuring that your journey is not just about the destinations, but also about smart, seamless, and secure transactions.

The neobank revolution — a deep dive into the Revolut card

In the ever-evolving landscape of finance and travel, a new player has emerged, challenging the status quo and reshaping the way we think about money on the move: the Neobank. Picture a bank stripped of its brick-and-mortar confines, existing purely in the digital realm, agile and tailored for the modern traveler. Among the vanguards of this revolution is the Revolut card, a beacon for those seeking to navigate foreign lands without the weight of hefty commissions.

What exactly is a neobank? At its core, it’s a digital-only bank, unburdened by traditional overheads and bureaucracy. This lean model allows for a plethora of benefits, chief among them being reduced fees. Enter Revolut, a card I’ve come to rely on during my extensive travels. The beauty of Revolut lies in its simplicity. It operates as a prepaid electronic wallet, ensuring you never overshoot your budget. Load it up with your chosen currency, and you’re set to explore the world, with conversions either preset or dynamically adjusted at the point of transaction.

In the dynamic world of global finance, Revolut emerges as a trailblazer, championing the cause of commission-free exchanges. This groundbreaking feature empowers travelers and global citizens alike, allowing them to transact across borders without the nagging bite of hidden fees or unfavorable rates.

Instead of grappling with the traditional banking system’s often opaque and costly conversion processes, Revolut users enjoy real-time exchange rates, mirroring the market’s pulse. This ensures that every transaction, be it a quaint café purchase in Paris or a hotel booking in Tokyo, is executed at the most favorable rate, devoid of any hidden markups. In essence, Revolut’s commission-free exchanges herald a new era of financial transparency and freedom, making global spending as straightforward as a local transaction.

ATM withdrawals with Revolut are a breeze, offering a generous limit of around 200€ per month without incurring commissions. Venture beyond this, and a 2% fee comes into play, mirroring the rates of conventional international cards. But here’s the kicker: getting your hands on a Revolut card can be as cost-free as its transactions. With an invitation from an existing user, the card is yours without a fee. Without an invite? A nominal charge of around 7€, excluding express delivery, stands between you and this game-changer.

However, every rose has its thorn. While Revolut operates under the trusted banners of Mastercard or Visa, it’s essential to note that it doesn’t offer the comprehensive insurance coverage typical of traditional international cards. Upgrades are available, but they come with their own set of fees. My advice? Retain your conventional card, not just for its insurance perks but also as a reliable backup. In certain regions, like Romania, direct transfers to Revolut face restrictions. Your traditional card then becomes the bridge, ensuring your Revolut wallet remains flush and ready for action.

In the grand odyssey of travel, the Revolut card is more than just a financial tool — it’s a companion, ensuring your journey is as seamless as it is memorable. But like with every card, you should thoroughly compare Revolut card pros and cons before signing up for it.

A balanced travel wallet to avoid paying commissions

As the sun sets on our journey through the labyrinth of global finance and travel, we arrive at a pivotal realization: the art of balancing our travel wallet. In the vast mosaic of experiences that travel offers, the way we manage our finances plays a subtle yet defining role. Diversifying payment methods isn’t just a strategy but rather a mantra for the modern traveler.

Remember the golden rules: Equip yourself with a mix of cash and card, ensuring you’re never caught off-guard in any corner of the world. Resist the siren call of airport and border exchange kiosks without first arming yourself with knowledge of the official rates. Your trusty international card? It’s not just for swiping — it’s your safety net, your backup plan. And when faced with the choice at an ATM in a foreign land, let the local currency be your guide.

For those who find themselves constantly chasing horizons or setting off on extended sojourns, the neobank card emerges as the unsung hero, cutting through the noise of commissions and fees. As we wrap up this expedition, my hope is that you’re now equipped with the insights and tools to navigate the financial intricacies of travel. May your adventures be as boundless as the skies, and may your wallet remain free from the weight of unnecessary commissions. Bon voyage!

Mathieu, the dynamic husband of Mirela The Travel Bunny, comes from the romantic boulevards of France and has since made Bucharest, Romania his home. As an astute engineer with a penchant for unraveling the intricacies of systems, he has delved deep into the world of finance, mastering the nuances of avoiding paying commissions abroad. His expertise doesn’t stop there: Mathieu has become a trusted voice on the Revolut card pros and cons, ensuring travelers get the most out of their adventures without the financial pitfalls.

Beyond his technical prowess, Mathieu’s passion for exploration and his keen eye for detail make him a connoisseur of global experiences. Whether he’s savoring the perfect slice of pizza or indulging in the creamy layers of a tiramisu, he approaches life with a blend of curiosity and humor. In his own succinct style, when prompted to share a tidbit about himself, he simply quips, “Something”. Trust in Mathieu’s guidance, and embark on a journey that’s as financially savvy as it is enriching!

You too can become a guest blogger on The Travel Bunny. Submit a free guest post!

After learning how to avoid paying commissions abroad, check out these travel blog posts

How to travel Europe on a budget

6 ways to save money on your next budget solo trip

Travel websites: Pros and cons of travel deals